United Midwest Savings Bank deposit products:

A Certificate of Deposit (CD) at United Midwest Savings Bank is a great way to save for today and tomorrow. With a variety of terms and competitive rates, your money will make a safe, guaranteed rate of return for whatever your plans may be.

To protect privacy and personal information, new customers must open their initial accounts in-person at one of our branch offices.

CD Rates FAQ

-

A Certificate of Deposit (CD) is a type of savings product designed for people who want a safe, predictable way to earn interest on money they don’t need to use right away. CDs are considered a time deposit account where you agree to keep your money deposited for a fixed period—called the term—in exchange for a guaranteed interest rate.

-

1. Guaranteed, Predictable Returns

- CDs offer a fixed interest rate for the entire term, which means your return is locked in for the term, it’s protected from market volatility, and you know exactly how much you’ll earn at the end of the term.

2. Very Low Risk

- CDs at United Midwest Savings Bank are covered by FDIC insurance. Talk with one of our bankers for more details..

3. Perfect for Savings and Investment Goals

- CDs are ideal for saving toward a specific future need, such as retirement, education, housing, travel and other major purchases.

4. An Option for Investment Strategy

- CDs can be used as part of a diversified investment strategy. They allow a counterbalance to riskier investments.

-

Yes. One of the stipulations to earn interest on a CD is that you keep all your initial deposit in the account for the entire term of the CD. If you choose to withdraw all or some of the money out of the account before the term, then a penalty is assessed, because withdrawing the money is in violation of the account agreement. At United Midwest, this penalty most often means forfeiting any or all interest earned. Keep in mind that each bank sets its own rules so penalties can vary from institution to institution.

-

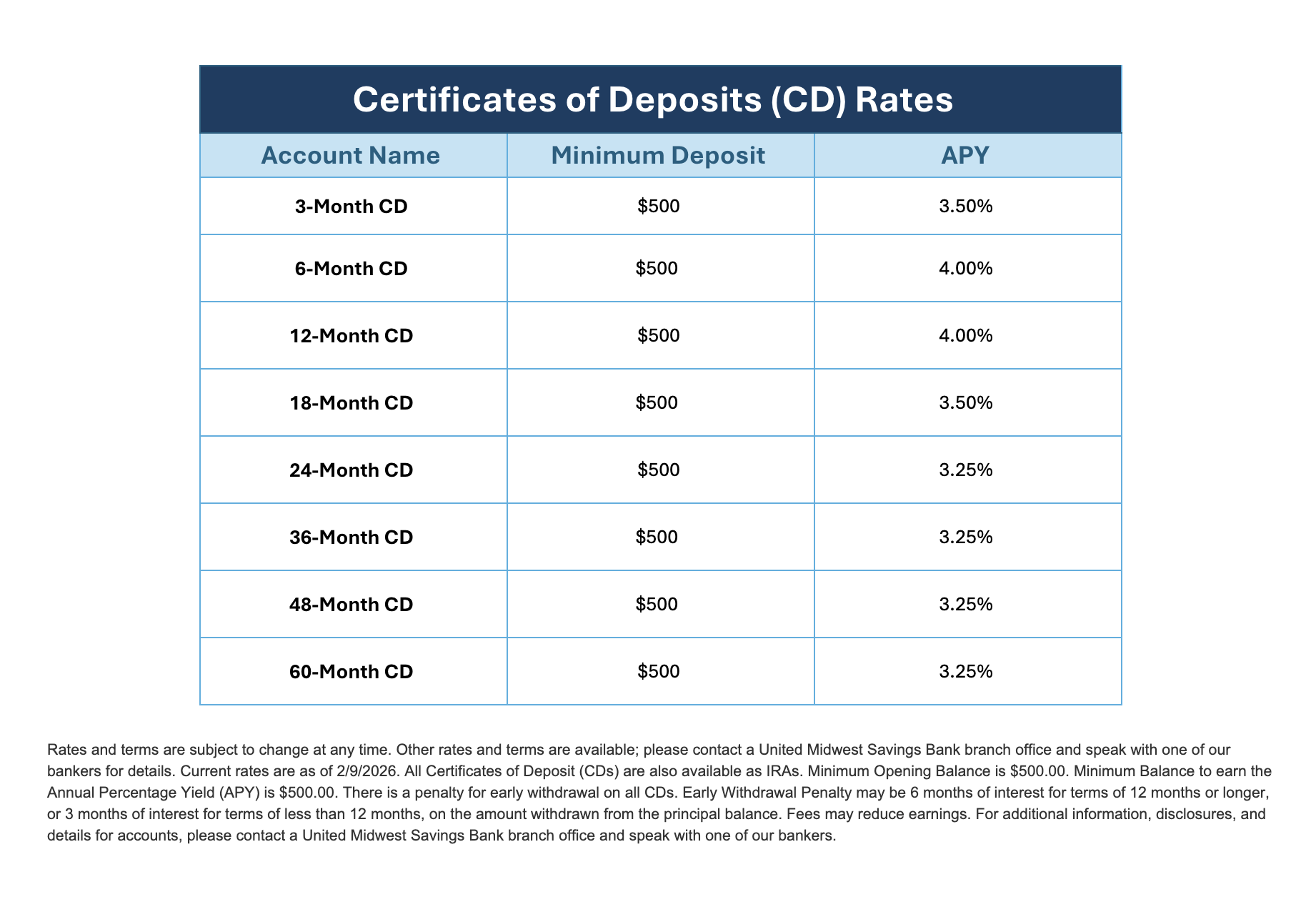

At United Midwest Savings Bank, you can open a CD with a minimum of $500 for any current terms or rates. Banks are permitted to set their own minimum deposits for their accounts, so that is something to watch for when you are deciding where you’d like to open a CD.

-

All United Midwest Savings Bank CDs are available as an IRA. Please talk with one of our bankers if you’d like to open an IRA. They will guide you through the process.

-

Just stop in one of our 6 branch locations to open a CD. Please remember to bring a valid form of identification and your initial deposit for your CD account. Identity and funds verification are both required to open a CD.